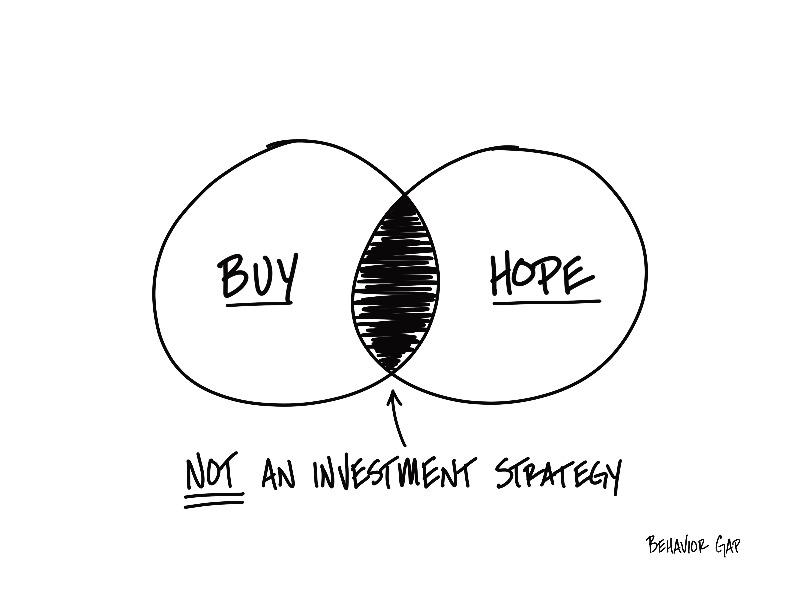

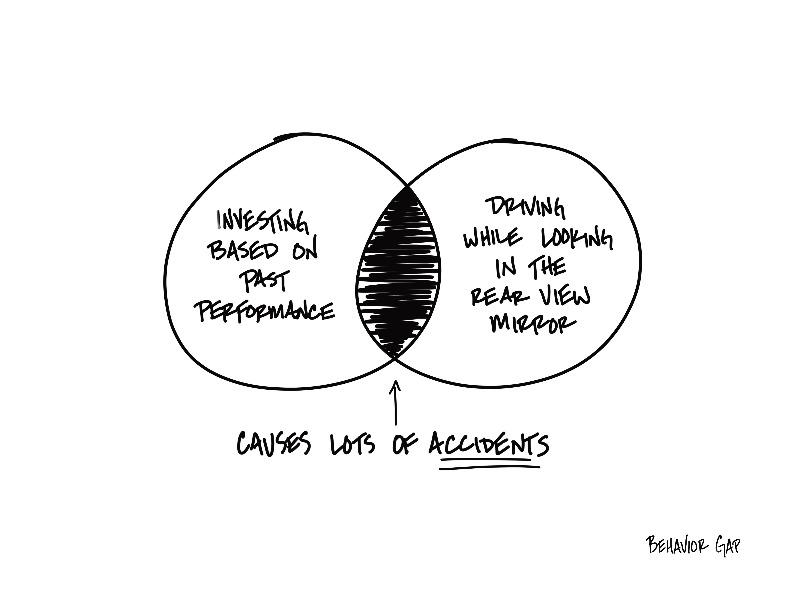

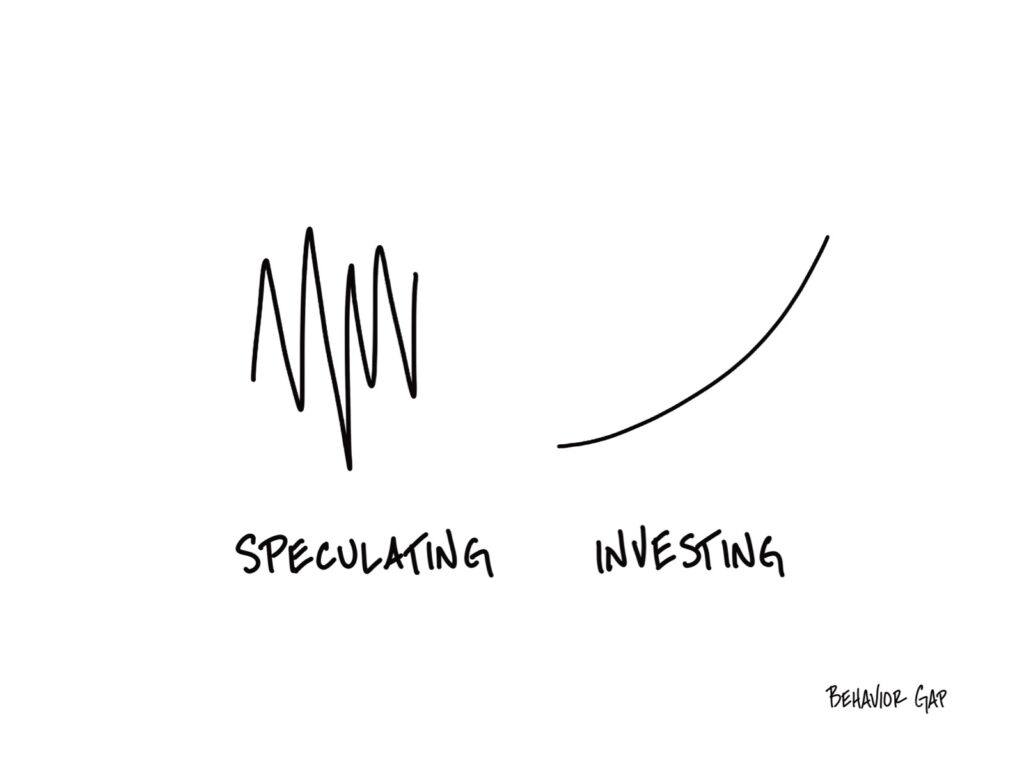

There’s a difference between speculating and investing, and it pays to know what the difference is.

Speculating is exciting, full of breathtaking ups and downs. If you chart it over time, it looks like a heartbeat. Probably an elevated one.

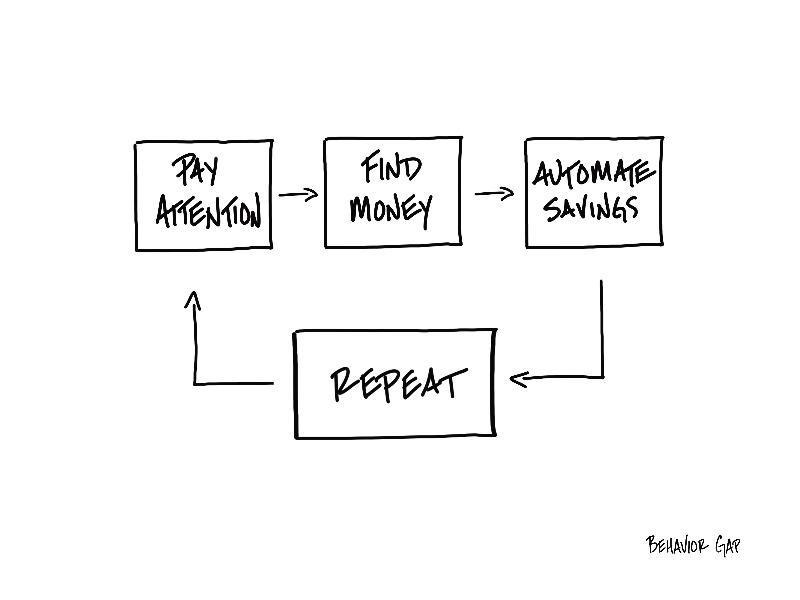

Investing, on the other hand, is slow and boring. In the short term, you may have some ups and downs. But if you chart investing over time (over many years of time), it looks like a long, slow curve upward.

Speculating is like a Vegas casino. Investing is like watching grass grow.

Know which game you’re playing.

-Carl

P.S. As always, if you want to use this sketch, you can buy it here.