The following is a message from the Center for Personal Finance Disease Control about a particularly dangerous virus called Pretend Investor Disease (PID).

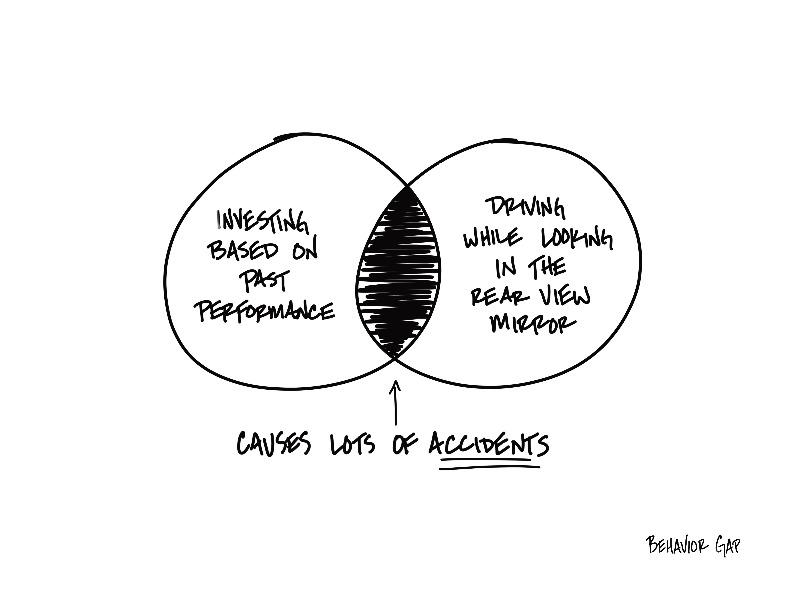

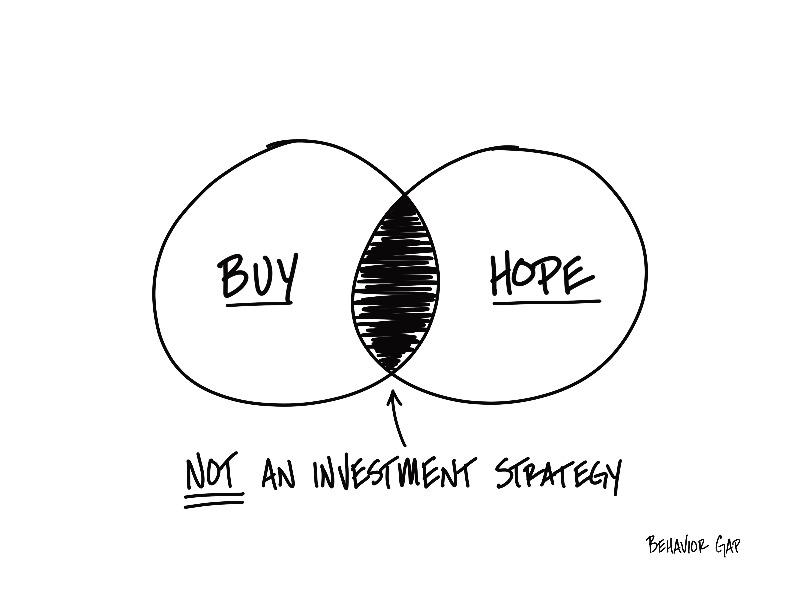

PID is an especially malignant disease that, if left untreated, can suck your savings dry. It works by convincing you to buy an investment at a silly price for no other reason than the hope that it will continue to go up so you can sell it to someone else at an even sillier price.

Warning: This. Is. Not. An. Investment. Strategy.

There’s actually a name for the behavior PID causes—it’s called The Greater Fool Theory. It’s the idea that we can get away with doing something foolish because we assume that somebody else is going to come along and be even more foolish. See: Ponzi Schemes.

PID is incredibly contagious. The more you hang around pretend investors, the more you will be exposed to dangerous disease-spreading agents like insider tips, hot stocks, and hashtags.

If the thought, “I’m going to buy this and hope it keeps going up,” occurs to you, you may already be infected.

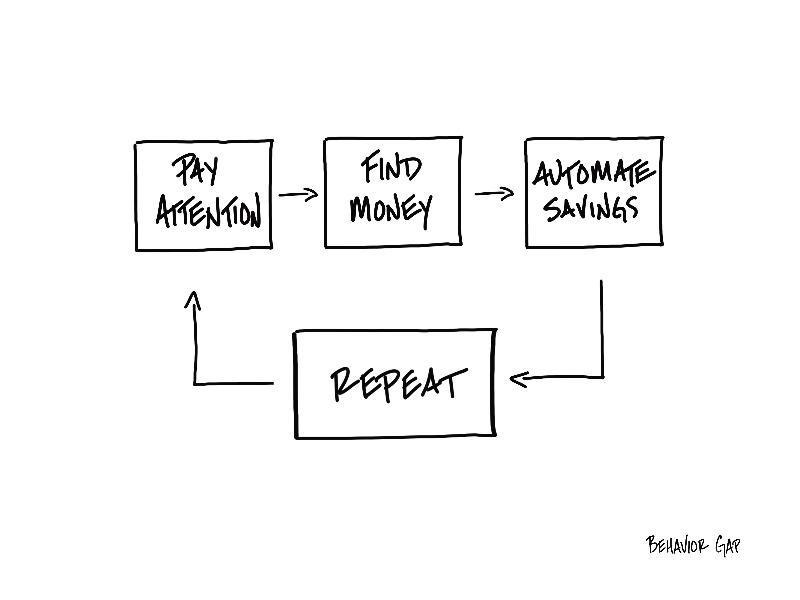

1- Stop what you are doing immediately.

2- Do. Not. Buy. That. Stock.

3- Seek help from a trained professional (e.g., a Real Financial Professional).

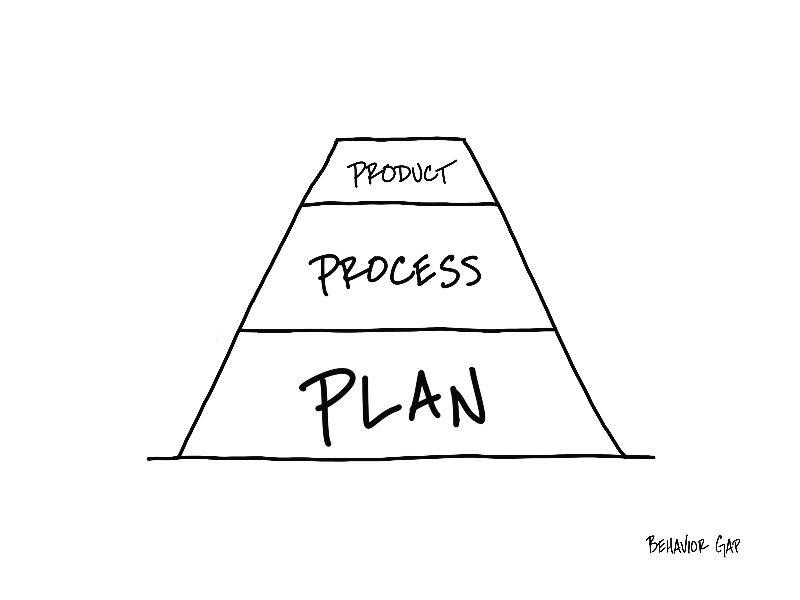

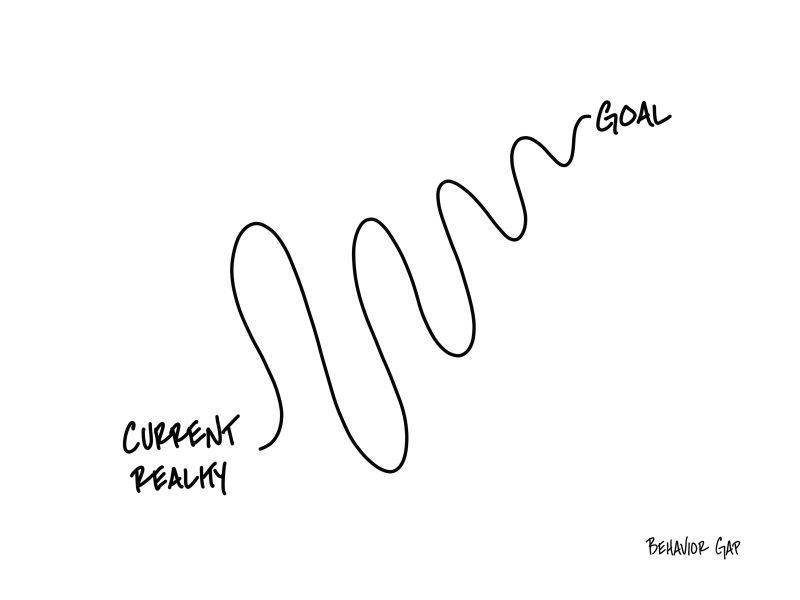

So far, the only way we know to combat PID is to have a rock-solid investing plan, based on your values and goals, that you don’t change when other people around you are doing things that look foolish.

PID appears to be all over the world. You may even run into asymptomatic carriers who have gotten wildly wealthy from hope-based investing by sheer luck. Just remember that for each of them, there are 10 more investors for whom PID has caused financial ruin.

Be safe out there, people, and stay vigilant.

-Carl

P.S. As always, if you want to use this sketch, you can buy it here.