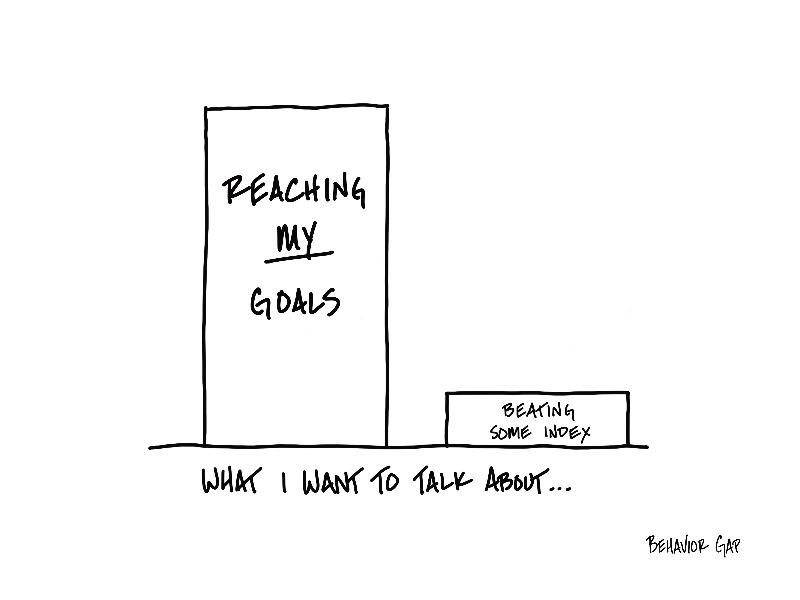

When it comes to personal finance, what matters is not beating some index. What matters is meeting your goals.

An index, of course, is just a broad measure of how a particular market has done. Think of it as the average. The investment industry seems to think their entire purpose in life is to convince you that the best thing you could ever do is hire someone to help you beat an index.

Whether that’s even possible is debatable, but let’s just focus on why it doesn’t even matter.

Pretend you live in some magic fantasy world where all of your dreams (according to the investment industry) come true, and you actually beat an index every quarter for your whole life. I hate to burst your bubble, but it’s completely possible—even in that unlikely scenario—that you don’t meet any of your financial goals.

Why? Because beating an index has nothing to do with meeting your personal financial goals! That has everything to do with careful financial planning.

Now let’s flip that scenario on its head. You slightly underperform the index every quarter for your whole life. But because of careful financial planning, you meet every one of your financial goals.

Doesn’t that sound a heck of a lot better?

-Carl

P.S. As always, if you want to use this sketch, you can buy it here.

. . .