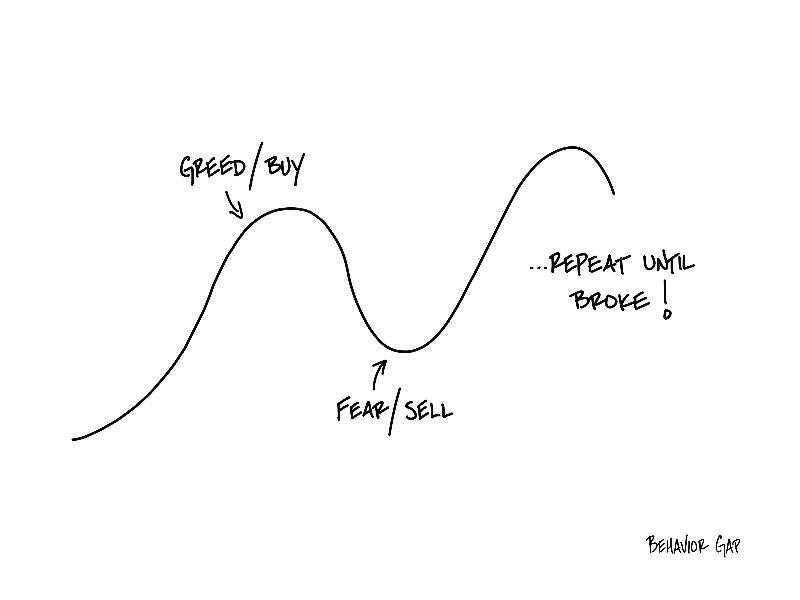

Most of us make the same mistake with our money over and over: we buy high out of greed and sell low out of fear.

Just look at mutual funds.

At the top of the market, we can’t buy fast enough. At the bottom, we can’t sell fast enough. And we repeat that over and over until we’re broke.

Can you imagine doing this in any other setting? Imagine walking into an Audi dealership and saying, “I need a new A6.” The salesperson says, “Oh my gosh, you’re in luck, we just marked them up 30%.” And you say, “Awesome, I’ll take three!”

Look, I get it.

We’re hardwired to get more of what gives us security and pleasure, and run away as fast as we can from things that cause pain. That behavior has kept us alive as a species. Mix that with our desire to be in the herd, the feeling that there’s safety in numbers, and you get a pretty potent cocktail.

When everyone else is buying, it feels like if we don’t join them, we’re going to get eaten by the financial version of a saber-toothed tiger.

But it doesn’t take a genius (or Warren Buffett) to see that this behavior is terrible for us when it comes to investing.

-Carl

P.S. As always, if you want to use this sketch, you can buy it here.

. . .