In 2012, I sat down with Susan Johnston Taylor at US News for a Q&A. I shared tips for avoiding common financial blunders and setting money goals. You can read the original article here: How to Break Bad Money Habits in 2012.

What are some of the most common money mistakes you’ve seen clients make or perhaps that you’ve made yourself?

One mistake that we’ve made way too often in relationship to investing is this human tendency we have to buy high and sell low. We all know that successful investing is about buying some asset for a low price, and then selling it sometime later for a higher price. But we all tend to do the opposite. We tend to get very excited when the market’s doing well. We all pile in just in time for it to go down. Then it goes down, we all get nervous and scared, and we jump out. So it sounds really simple and cliché, but one of the biggest mistakes we make is buying high and selling low, and doing it over and over again.

Any tips on breaking that pattern?

First, we can recognize the tendency to do it. Fixing any problem always starts with admitting that you have one. And with investing, it’s pretty easy to go back the last three years, last five years, last 10 years and look at the decisions you’ve made. Did you buy in late ’99? No. Were you liquidating your 401(k) account in 2002?

Number two, step back and ask yourself why you’re doing these things. Take the time to build a plan. Not some big, scary one-inch thick financial plan. Just take the time to step back and say, “Where am I today, and where do I want to go?” And then recognize that your investment portfolio should match that plan.

And then thirdly, go on a media fast. Stop listening to it, or start realizing a lot of what we hear in the financial press is more about entertainment than it is about advice.

You wrote a very candid piece for the New York Times about short-selling your own home and some of the decisions that led you to that point. If you could go back in time, what would you do differently?

Without trying to sound too self-serving to the industry, I would have a planner involved in my life. We recently hired a financial planner three, four months ago. And I am convinced that had I had this particular planner involved in my life five or six years ago, I wouldn’t have made those mistakes.

Now, I realize there’s some baggage as soon as you say, “Hire a financial planner.” But maybe the easier way to say it would be get a second opinion about major decisions. Ask a friend, a parent, a family member, a CPA, an attorney before you make major financial decisions, because we’re just too close to it to be objective.

Sometimes all it takes is just explaining to somebody what you’re thinking about doing out loud. In some cases they don’t even have to say anything. All you have to do is hear it out loud, and you realize it was a dumb idea. So I would have hired a qualified financial professional to help me avoid doing stupid things.

Your book is coming out in January, just after many people will have gone on a month-long spending binge. What should readers do to prevent that post-holiday hangover?

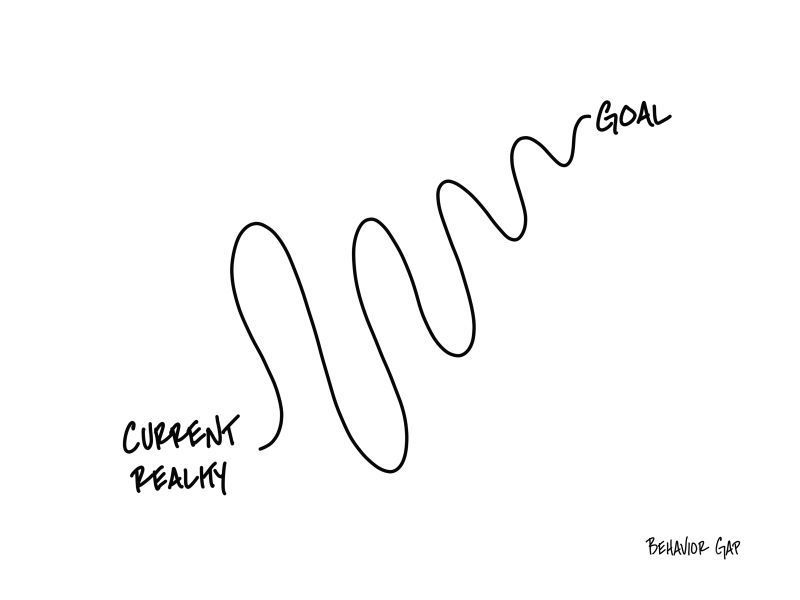

Most of these problems I get asked about are planning problems. Take the time to give yourself permission to take no blame, and no shame, and get really clear about your current financial reality. Where are you today? I used to think that was the easy part, but the reality is, most of us haven’t even figured that out.

After you’re really clear, you have some shot at figuring out where you want to go. If you have kids, what do you want to help pay for? Can you pay for college? When would you like to retire? This may be 30 years out — it may seem like a long time — but just figure out where you are today, and where you want to go. I’ve noticed a huge difference in people who’ve gone through that process on their own or with help, and it seems to me that they have an easier time being disciplined about day-to-day decisions.

Give yourself permission to let go of the need for precision, and this is perpetuated by the industry, of course. When you sit down, you want to know exactly what your retirement is going to look like in 30 years, and you don’t even have any idea where you’re going to be next month. That’s an overwhelming thing. So, at least start with the idea of understanding where you are today and realize this is going to be a process, and you’re going to course-correct.

How often should people be looking at their goals? Is it enough to make financial resolutions at the beginning of each year, or should you do it more often?

As often as you can. If you made a plan to do this once a quarter, I think it would be incredibly valuable. For example, let’s say you set a goal to save $100 per month into your child’s 529 account, because you decided education was really important, it was something that you really valued. Three months later you wake up and say, “Gosh, we said we’d save $100 a month and we only did that the first month. Is it still really important to us? Yes, it is. Maybe we should automate that.” Three months later, again no blame or shame, you think, “Oh wow, look, we saved $100 a month.” So I think quarterly is a good time.

Anything else you’d like readers to know about your book?

One of my goals was to write a personal finance book for people who never read personal finance books. And what I mean by that is, there’s this group, 35 to 50-year-olds, educated, typically have decent incomes, that are starting to realize, “Wow, I’ve got some important financial responsibilities that I haven’t thought that much about.” But you don’t really feel like running out and grabbing the latest Dave Ramsey book or whatever. So it was a personal finance book written for people who would never read personal finance books, and it’s not meant to be prescriptive. It’s really meant to sort of open the door to a bunch of conversations, because a friend of mine always says, “Personal finance is more personal than it is finance.” So I think one of the challenges is trying to get people the tools to have the right conversations instead of being very prescriptive about exactly what you should do.

. . .