I want to talk to you about scary markets. For the sake of this particular subject, I want to be blunt and a little bit in your face. So for the next few minutes, please, just think of me less as your friend and more as your Scary Markets Drill Sergeant. O.K.? Great.

Now, you may be saying to yourself, “Why is he talking about this now? The markets aren’t even that scary.” That’s true. And it’s also true that I can’t predict when the next bad market is coming.

But I can predict that another bad market will come again, eventually. And when it does, you’ll want to have a plan. That’s precisely why now is such a good time to hash this out. Because you don’t wait until your house is in flames to buy a fire extinguisher, right?

Preventing your clients from bailing out of a well-designed investment plan during a scary market is your single most important job as a real financial advisor. But here’s the problem: if your experience has been anything like mine, no one ever taught you how to do that! I got the best training in the industry, earned professional designations, attended conferences, and I can’t remember a single time where someone taught how to actually talk to people—let alone communicate when people are acting crazy!

And yet the success of all the work a real financial advisor does depends on your ability to talk to people. You can have the best financial plan in the world, design the best portfolio, pick the best investments… and if you can’t communicate in a way that gets people to behave when times are tough, all that work is gone.

I know this is a problem because I hear about it from readers. In fact, one conversation I had with a friend captures the problem perfectly. He has a lot of money with a very high-end wealth management firm. He shared that over this last weekend, his advisor sent an email that he thought would address the concerns he had about the impact of a recent global event.

It was two lines. Yeah, two lines. And here’s the kicker: one of them was “…Stay the course.” He was so mad!

He pays a ton of money every year to his advisor, and the last thing he wanted (or needed) was a two-line email telling him to stay the course. He told me that he knew that was the right thing to do, but the lack of empathy and the failure to recognize that what was going on in the markets was scary shocked him.

As he was venting to me about this experience, I decided to release two videos to help. Think of these videos as A Manual for Scary Markets.

When the markets get scary, we’re often the only thing standing between them and our clients doing something foolish. But to be that release valve our clients need, we need to have an internal conversation with ourselves first. If you’re continually walking people in off the ledge, and you’re not taking care of yourself, it won’t be long until you’re the one out on the ledge. My goal with these videos is to help you understand your true value as a REAL financial advisor.

Watch my free mini-course about scary markets here.

Remember I said that no one ever taught me how to communicate as a financial advisor… once I realized how critical this skill was I decided to learn it myself. I read hundreds of books, talked to everyone I could, researched the best communicators, and asked thousands of clients how they wished their advisors would talk to them. I learned a ton in the process. And I packed as much of that as I could into these two videos.

One critical lesson I want to make sure you hear is when someone is feeling scared and tempted to do something that feels totally reasonable at the moment, but is clearly irrational long-term, they don’t want someone reasoning with them without first taking that time to empathize. Trying to reason with someone thinking irrationally doesn’t work. If you doubt that, try it with a teenager!

When you understand that, you start to see why the standard responses most advisors give (and the one I was guilty of as well) is so embarrassingly bad. What most of us do is we throw facts and figures at clients when they call scared because of the news of something like a recent global event. We give them data about the markets and the economy. During bear markets, we cite historical data about how long the average bear market lasts, and how deep they go—and of course how awesome the recovery always is!

This stuff can be important, but it is not what people want to hear when they are scared… the last thing they want to hear at that moment is historical data! Instead, they want you to understand. They want you to listen. They want to know you hear them. That is a different skill set, and it is one I hope these two videos will help you develop.

The first one focuses on what we (advisors) need to do to be ready to deal with this, and the internal dialogue we need to have with ourselves before we talk to our clients. The second video walks you through how to talk to clients during scary markets. I even highlight specific tips and even include exact scripts I’ve used hundreds of times.

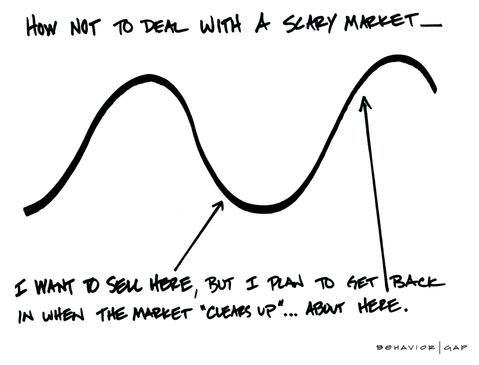

I hate to be annoying, but I really want to hammer this conversation home. It doesn’t make a lick of sense to sell a portfolio tailored for you when the market is low, and then buy it back when the market is higher. It makes infinitely more sense to simply keep your portfolio through the scary times and tough it out. Right, soldier?

You may already have this all figured out and know exactly what to say to clients. But if you’re struggling, A Manual for Scary Markets can help. I know you can do it, and I know your clients will appreciate it.

Think of scary markets as something of a lifeboat drill. This is meant to help you remember that when the ship goes down and you find yourself in the lifeboat scared and cold, you don’t throw common sense to the wind and jump in the icy water. Just stay in the rescue boat, tough it out through the turbulent times, and wait until the next big ship comes to pick you up to carry you safely to your destination.

. . .