We love to win, but not as much as we hate to lose.

For example, pretend that a few years ago, you hired an advisor and built a diversified, low-cost portfolio based on your values and goals. But you still have a dirty little secret—the stock your brother-in-law recommended years before that went down right after you bought it.

The bro-in-law stock clearly doesn’t fit in your plan. Every rational thought, every spreadsheet, and every calculator tells you it’s past time to get rid of it. But you don’t, because making the choice to sell means admitting that you’ve made a mistake and realizing a loss.

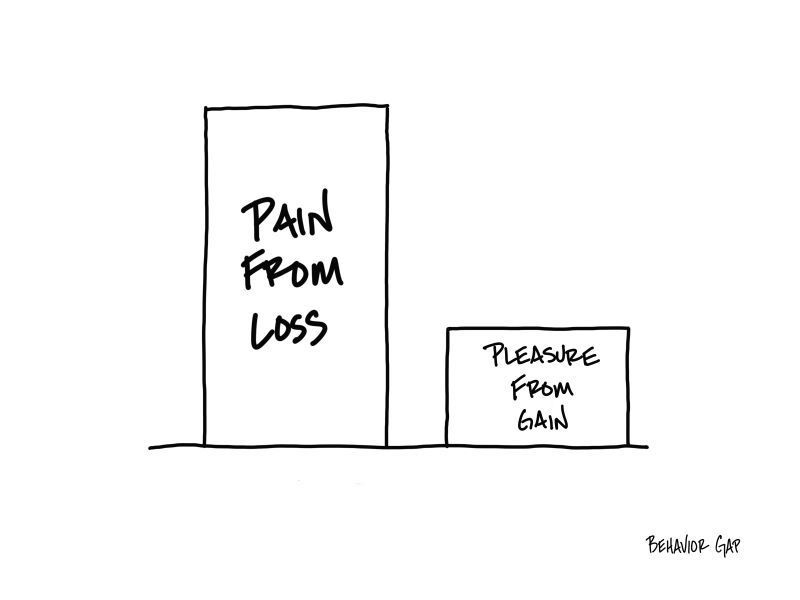

This is called Loss Aversion. The pain we feel when we lose outweighs the pleasure we feel when we win. We’re willing to leave a lot of money on the table to avoid the possibility of losing.

And that’s why you hang on to the brother-in-law stock long after it should be sold—because you just don’t want the pain. The way to deal with this is a little trick I call The Overnight Test.

Here’s how it works.

Imagine you went to bed and, overnight, someone sold that brother-in-law stock and replaced it with cash. The next morning, you have a choice: You can buy it back for the same price, or you can take that cash and add it to your well-designed portfolio. What would you do?

To date, no one has ever told me they would buy back the stock.

The Overnight Test is great because it changes your perspective from realizing a loss to (intelligently) investing cash. It gives you the emotional distance necessary to make the right decision. And sometimes, that’s all it takes.

-Carl

P.S. As always, if you want to use this sketch, you can buy it here.

. . .