One of the craziest things we do as humans is take the recent past and project it indefinitely into the future.

As the news cycle has sped up, this problem has only gotten worse. It used to feel like the “recent past” went as far back as a couple of years. Today, it often feels like “recent” only applies to the last couple of minutes (or better yet, social media posts).

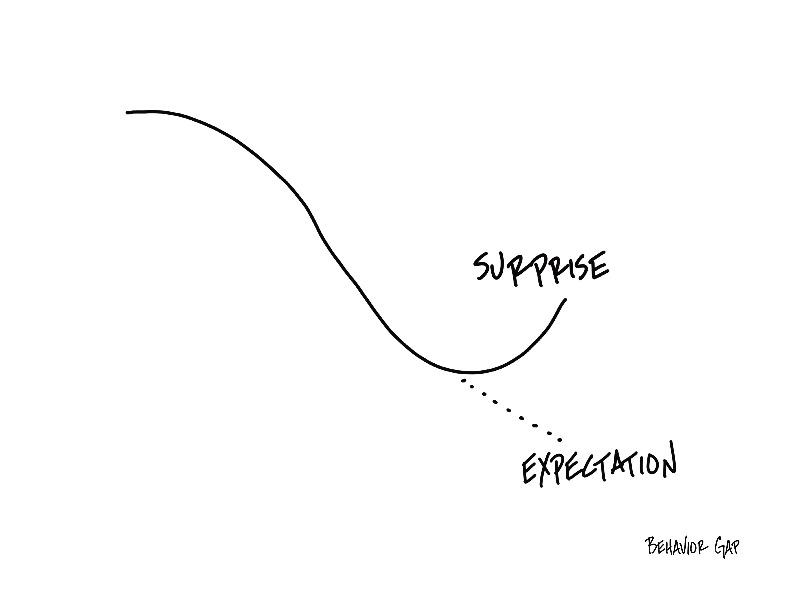

We think if things are going terrible, they are going to continue being terrible forever. If your portfolio value seems to be dropping, it’s tempting to say, “At this rate, if this continues, I won’t have any money [insert number of months] from now.”

On the other hand, if things are going well, we expect them to continue going well forever.

If, for each of the past three years, you’ve gotten a bonus in January, it may be tempting in October to factor that bonus you will surely get in January into a big financial decision. Of course, it’s terribly disappointing if that bonus doesn’t come (and by the way, there’s no guarantee that it will).

We would do well to make our memories go back just a little bit further than the common goldfish. That way, we may find ourselves recalling a time when the bonus didn’t come or the market was better.

If we can do that, we stand a much better chance of avoiding falling into the same traps over and over again.

-Carl

P.S. As always, if you want to use this sketch, you can buy it here.

. . .